The Integration Tax: Why Your Technology Budget Disappears Before It Delivers

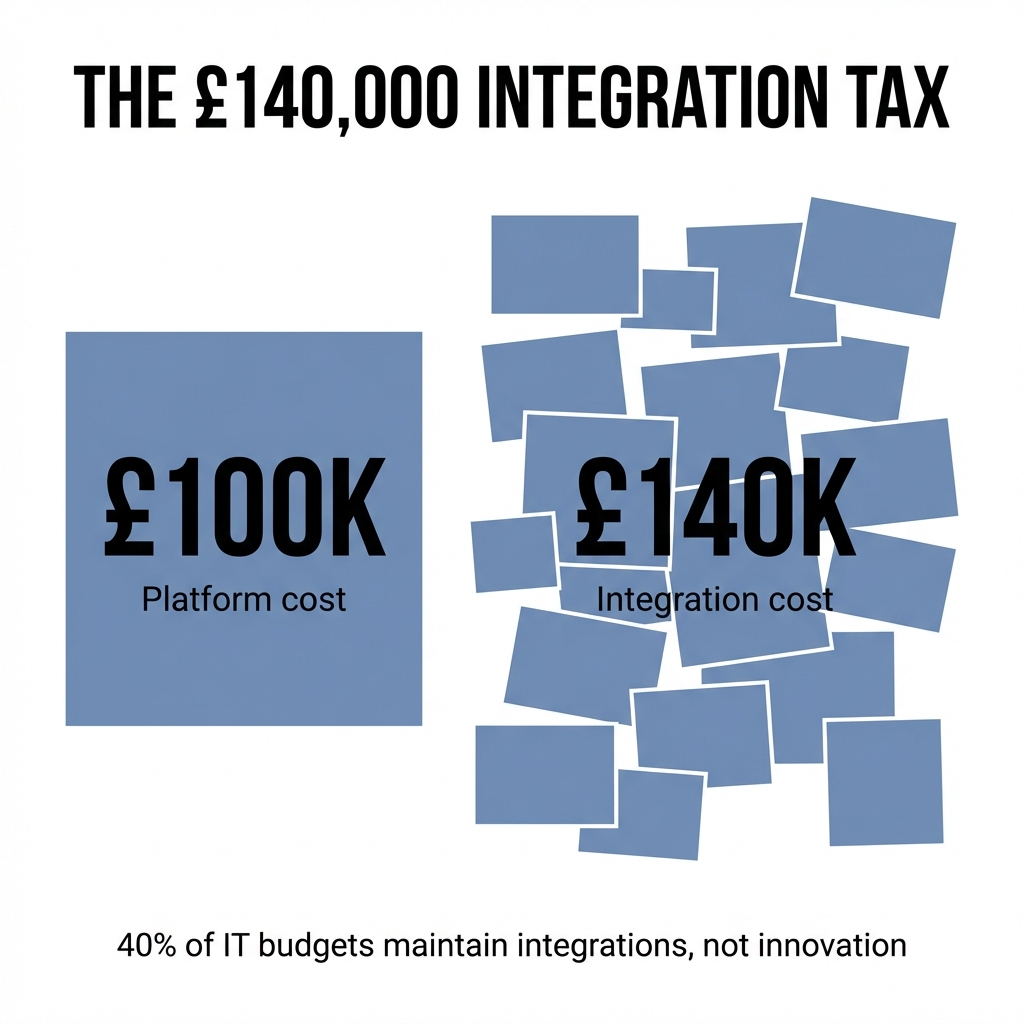

McKinsey puts a number on it: 40% of IT budgets go towards rectifying existing integration issues rather than building new capability. That's not innovation spending. That's maintenance spending disguised as transformation.

I watch firms spend £200,000 on a platform and another £150,000 making it talk to everything else.

This is the integration tax. You pay it every time you connect systems that were never designed to work together.

McKinsey puts a number on it: 40% of IT budgets go towards rectifying existing integration issues rather than building new capability. That's not innovation spending. That's maintenance spending disguised as transformation.

The Hidden Overhead Nobody Budgets For

Gartner estimates that integration costs consume up to 40% of digital transformation budgets, often exceeding the licence fees themselves.

Think about that. You buy a tool for £100,000. You spend £140,000 connecting it to your existing infrastructure.

The tool works perfectly. The integration breaks constantly.

Point-to-point connections multiply faster than you can maintain them. Each new tool introduces its own mapping requirements, governance overhead, and maintenance burden. Before long, you have an unmanageable tangle of scripts, middleware, and manual workarounds.

IDC reports that 70% of CIOs identify integration complexity as their top barrier to delivering new digital services. Not budget. Not skills. Integration.

Why Law Firms Pay This Tax More Than Most

Law firms operate in an environment where risk aversion meets procedural conservatism. You can't simply rip out existing systems and start fresh.

The result? Fragile integrations that work until they don't.

Document workflows still depend on network drives despite your Microsoft 365 investment. Security tools operate in isolation rather than as a unified posture. Your IT team spends more time connecting systems than improving them.

This isn't a technology problem. It's a partner selection problem.

The Firms Escaping the Integration Tax

The firms avoiding this trap share one characteristic: they chose technologies designed to extend their existing platform rather than compete with it.

Microsoft 365 offers an advantage here. The number of vendors supporting Microsoft 365 integration is staggering. It's arguably the most integrated SaaS service available today, with first-party vendor support for common enterprise systems like ERP, CRM, and HRIS.

More importantly, a shared security framework amongst Microsoft tools minimises vulnerabilities that arise from disjointed systems.

When your document management, case management, and communication tools operate within the same ecosystem, you reduce the integration surface area. You spend less time maintaining connections and more time improving workflows.

What This Means for Your Next Technology Decision

Before you sign that contract, ask three questions:

Does this tool extend our existing platform or compete with it?

What's the true integration cost over three years?

Who maintains the integration when it breaks?

The integration tax compounds over time. The longer you pay it, the more it constrains your ability to invest in actual capability improvement.

Choose technologies that embed within your existing behavioural infrastructure. Choose partners who understand that adoption, not deployment, defines success.

The integration tax is optional. You just have to know what you're looking at before you commit.